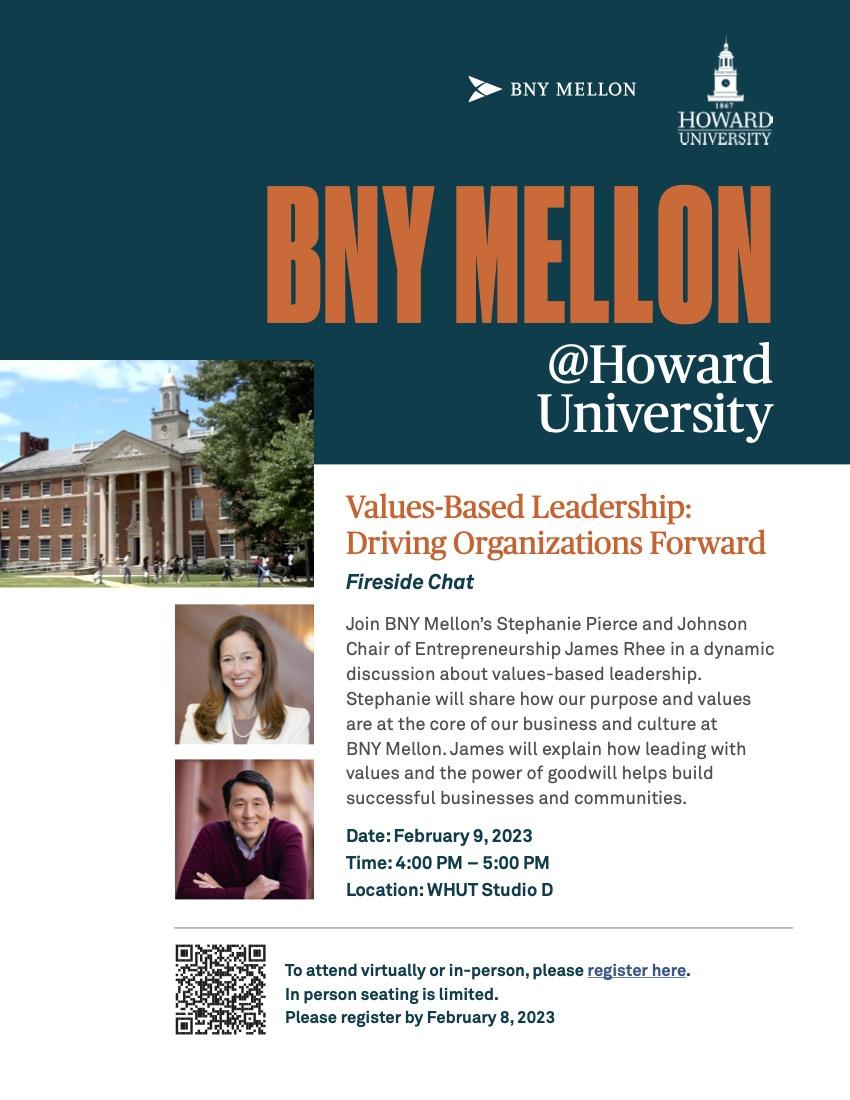

WASHINGTON – On Thursday, February 9 at 11:10 a.m. ET, the Howard University School of Business will launch its annual Executive Lecture Series with a visit from finance expert Stephanie Pierce in the School of Business auditorium. Pierce is the Chief Executive Officer of Dreyfus, Mellon & the ETF advisory business at BNY Mellon Investment Management. Following the lecture, Pierce will join James Rhee at WHUT studios for a fireside chat on values-based leadership. This year marks the 20th anniversary of the Executive Lecture Series at the School of Business.

Inclusive investing is this year’s lecture topic and will be presented to a group of approximately 200 students, professors, and business school executives. Following the program, selected faculty, staff, and students will be treated to lunch with BNY Mellon executives and School of Business deans. Students will get the invaluable opportunity to ask questions and gain insights from some of the world’s top business minds.

“For 20 years, the School of Business has provided students with access to some of the greatest minds of business through the Executive Lecture Series. This year we will continue that tradition of excellence by kicking the series off with Stephanie Pierce. She brings expertise in asset management and launching businesses that our students can immediately use,” said Anthony Wilbon, PhD, dean of the Howard University School of Business.

Pierce is an entrepreneurial investment management veteran with extensive leadership experience driving strategic change and commercial innovation. Over the course of her nearly three-decade career, Pierce has proven especially adept at spearheading the conceptualization, launch and growth of businesses and cross-platform initiatives that touch multiple business lines across large enterprises. She possesses a B.A. in International Relations from Stanford University.

She is a member of the Leadership Board at Beth Israel Deaconess Medical Center, the Board of Advisors for the Boston Ballet, the Advisory Board of the Journal of Portfolio Management, the Speakers’ Bureau of Women in ETFs and a Trustee for the US Ski and Snowboard Foundation Board.

Pierce joins an illustrious group of professionals that have participated in the initiative. Past lecturers include Bryan Moynihan, president and CEO of Bank of America, Sheryl Sandberg, former COO of Meta, Inc., Richard Parsons, former Chairman and CEO of Time Warner and Howard University trustee emeritus, and Robert Manfred, commissioner of Major League Baseball.

###

About Howard University

Founded in 1867, Howard University is a private, research university that is comprised of 14 schools and colleges. Students pursue more than 140 programs of study leading to undergraduate, graduate, and professional degrees. The University operates with a commitment to Excellence in Truth and Service and has produced two Schwarzman Scholars, three Marshall Scholars, four Rhodes Scholars, 12 Truman Scholars, 25 Pickering Fellows and more than 165 Fulbright recipients. Howard also produces more on-campus African American Ph.D. recipients than any other university in the United States. For more information on Howard University, visit www.howard.edu.

About BNY Mellon Investment Management

BNY Mellon Investment Management is one of the world’s largest asset managers, with $1.8 trillion in assets under management as of December 31, 2022. Through an investor-first approach, BNY Mellon Investment Management brings to clients the best of both worlds: specialist expertise from seven investment firms offering solutions across every major asset class, backed by the strength, stability, and global presence of BNY Mellon. Additional information on BNY Mellon Investment Management is available on www.bnymellonim.com.

BNY Mellon Investment Management is a division of BNY Mellon, BNY Mellon is a global investments company dedicated to helping its clients manage and service their financial assets throughout the investment lifecycle. Whether providing financial services for institutions, corporations or individual investors, BNY Mellon delivers informed investment and wealth management and investment services in 35 countries. As of December 31, 2022, BNY Mellon had $44.3 trillion in assets under custody and/or administration, and $1.8 trillion in assets under management. BNY Mellon can act as a single point of contact for clients looking to create, trade, hold, manage, service, distribute or restructure investments. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation (NYSE: BK). Additional information is available on www.bnymellon.com. Follow us on Twitter @BNYMellon or visit our newsroom at www.bnymellon.com/newsroom for the latest company news.