WASHINGTON, D.C., January 31, 2020 – Today, Howard University convened an important event focused on enhancing the economic strength and financial wellness of African Americans. The event, sponsored by TIAA and AARP, brought together industry experts for a discussion on the financial challenges African Americans face and potential solutions to critical issues, including financial literacy, saving for retirement, managing debt and student loans, home ownership, and wealth inequality.

WASHINGTON, D.C., January 31, 2020 – Today, Howard University convened an important event focused on enhancing the economic strength and financial wellness of African Americans. The event, sponsored by TIAA and AARP, brought together industry experts for a discussion on the financial challenges African Americans face and potential solutions to critical issues, including financial literacy, saving for retirement, managing debt and student loans, home ownership, and wealth inequality.

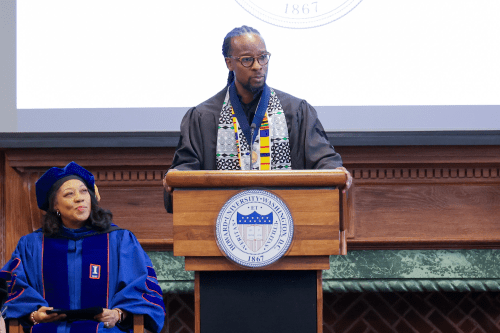

“In working with our students and the community, Howard University witnesses firsthand the economic challenges African Americans face, and we are striving to help find and implement tangible solutions,” said Howard University President Wayne A. I. Frederick. “We believe businesses, organizations, and higher education institutions can work together to solve these challenges today, so African American students, families, and communities can be successful tomorrow.”

The “Financial Wellness in the African American Community: Reviewing the Evidence, Spotlighting Innovation and Considering Solutions” event featured two discussions: the first assessed the current financial and economic landscape and challenges African Americans face, followed by a discussion around potential solutions that could help improve African Americans’ overall financial wellbeing.

“African Americans constitute a critical segment of our economy, but our 2019 Personal Finance (P-Fin) Index shows they often exhibit lower financial wellbeing and financial literacy than many other demographics,” said Roger W. Ferguson, Jr., President and CEO of TIAA. “Financial education is an important way to help address these challenges. We know that people who are more financially literate are more likely to plan and save for retirement, to have non-retirement savings, and to better manage their debt – all of which lead to improved financial outcomes and wellbeing.”

“Although AARP’s work is focused on advocating on behalf of people age 50 and over, some issues transcend age. One of them is financial literacy,” said AARP CEO Jo Ann Jenkins. “That’s why AARP is pleased to be part of this Howard University event that seeks to put the importance of financial resilience and savings firmly on the radar screens of the young African American leaders who comprise its community.”

CBS National News Correspondent Michelle Miller moderated the day’s conversations, in which insights were heard from top industry experts including:

- Camille Busette, Senior Fellow, Brookings Institution

- Barron H. Harvey, Ph.D., Dean, School of Business, Howard University

- Kilolo Kijakazi, Institute Fellow, Urban Institute

- Annamaria Lusardi, Denit Trust Chair of Economics and Accountancy, George Washington University School of Business

- Lisa Mensah, President and CEO, Opportunity Finance Network

- Stacey Tisdale, Financial Journalist, Author, CEO, Mind Money Media Inc.

- Frederick Wherry, Professor of Sociology, Princeton University

The “Financial Wellness in the African American Community: Reviewing the Evidence, Spotlighting Innovation and Considering Solutions” took place on Friday, January 31 at Howard University’s Cramton Auditorium.

About Howard University

Founded in 1867, Howard University is a private, research university that is comprised of 13 schools and colleges. Students pursue studies in more than 120 areas leading to undergraduate, graduate and professional degrees. The University operates with a commitment to Excellence in Truth and Service and has produced one Schwarzman Scholar, three Marshall Scholars, four Rhodes Scholars, 11 Truman Scholars, 25 Pickering Fellows and more than 70 Fulbright Scholars. Howard also produces more on-campus African-American Ph.D. recipients than any other university in the United States. For more information on Howard University, visit www.howard.edu.

About TIAA

With an award-winning1 track record for consistent investment performance, TIAA (TIAA.org) is the leading provider of financial services in the academic, research, medical, cultural and government fields. TIAA has $1 trillion in assets under management (as of 12/31/20192) and offers a wide range of financial solutions, including investing, banking, advice and education, and retirement services.

About AARP

AARP is the nation’s largest nonprofit, nonpartisan organization dedicated to empowering Americans 50 and older to choose how they live as they age. With nearly 38 million members and offices in every state, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands, AARP works to strengthen communities and advocate for what matters most to families with a focus on health security, financial stability and personal fulfillment. AARP also works for individuals in the marketplace by sparking new solutions and allowing carefully chosen, high-quality products and services to carry the AARP name. As a trusted source for news and information, AARP produces the world’s largest circulation publications, AARP The Magazine and AARP Bulletin. To learn more, visit www.aarp.org or follow @AARP and @AARPadvocates on social media.

1 The Lipper Mixed-Assets Large Fund Award is given to the group with the lowest average decile ranking of three years’ Consistent Return for eligible funds over the three-year period ended 11/30/15 (against 39 fund families), 11/30/16 (36), 11/30/17 (35) and 11/30/18 (35). Note this award pertains to mixed-assets mutual funds within the TIAA-CREF group of mutual funds; other funds distributed by Nuveen Securities were not included. From Thomson Reuters Lipper Awards, © 2019 Thomson Reuters. All rights reserved. Used by permission and protected by the Copyright Laws of the United States. The printing, copying, redistribution, or retransmission of this Content without express written permission is prohibited. Certain funds have fee waivers in effect. Without such waivers ratings could be lower. Past performance does not guarantee future results. For current performance, rankings and prospectuses, please visit the Research and Performance section on TIAA.org. The investment advisory services, strategies and expertise of TIAA Investments, a division of Nuveen, are provided by Teachers Advisors, LLC and TIAA-CREF Investment Management, LLC. TIAA-CREF Individual & Institutional Services, LLC, Teachers Personal Investors Services, Inc., and Nuveen Securities, LLC, Members FINRA and SIPC, distribute securities products.

2 Based on $1.1 trillion of assets under management across Nuveen Investments affiliates and TIAA investment management teams as of 12/31/19.

1062246