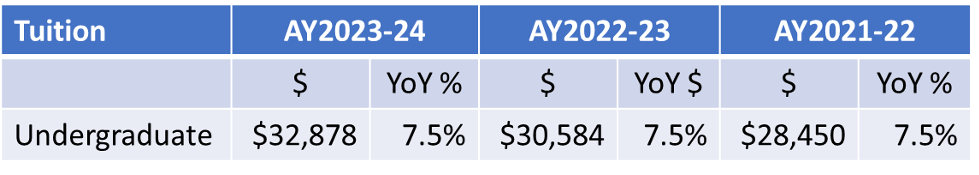

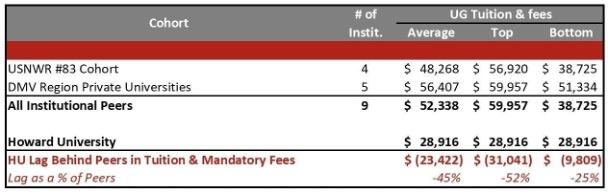

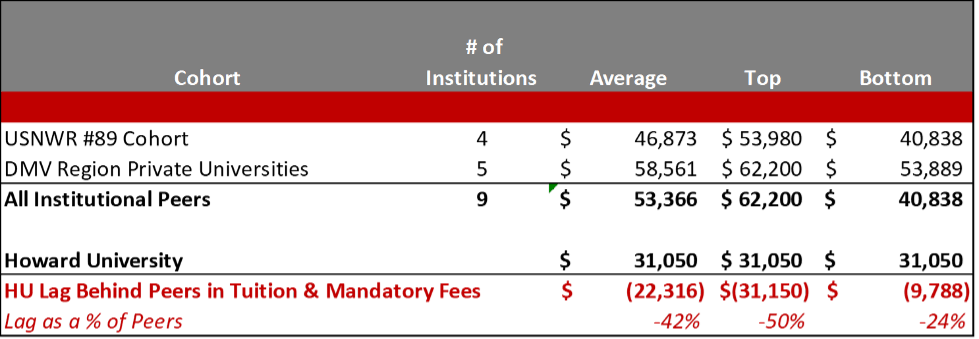

A 7.5 percent increase for the 2023-2024 academic year will raise tuition to $32,878. Despite the increase, Howard University’s tuition and mandatory fees remain significantly lower than comparable institutions.

According to data from the 2022-2023 academic year, Howard’s tuition and fees were 34 percent lower than institutions with similar U.S. News & World Report rankings, and 47 percent lower than private institutions in the Washington, D.C. area. Among the historically Black colleges and universities (HBCUs) with the five highest rankings, Howard’s undergraduate tuition and mandatory fees are only $2,418 higher than the average. Of note: Howard University is the only HBCU in the top 100 of national universities.

Net tuition and fees represent an important funding source for Howard, especially as it is unrestricted and grants the University the most flexibility in terms of pricing and use. Additionally, Howard strives to return tuition and fee revenue in the form of student scholarships. For fiscal year 2022, the University recognized a net tuition and fee revenue of $193 million; gross tuition and fee revenue was $357 million and institutional aid was $164 million. That means on average, for every dollar of tuition and fee revenue charged, 46 percent is given back to students.

It is important to note that living expenses, such as housing and dining, are not included in the mandatory fees. Room, board, and meal plans represent separate costs that students incur. While we recognize that the tuition and mandatory fees do not encompass the full cost of attendance, this particular snapshot provides meaningful insight into the affordability of a Howard education:

*AY2022-23 rate comparison

The University’s operating expenses have increased due to inflation, student services, regulatory requirements, and strategic investments for future growth. The tuition increase comes as the University, and the entire country, faces levels of economic inflation not seen in decades. In March 2023, the Consumer Price Index reported a 5 percent year-over-year inflation increase. As the cost of utilities, supplies, contract labor, travel, and more continue to escalate, the University’s operating budget must increase proportionally. Furthermore, the current labor market for retaining and recruiting faculty and staff is extremely competitive. Therefore, wage inflation is also impacting the University’s operating budget. As the University continues to return campus life to pre-pandemic levels of services and experiences, the investments in student life activities also continue to grow significantly.

Despite the difficult financial and economic environment, Howard University strives to keep tuition and fee levels modest by emphasizing other revenue sources.

Federal Appropriation

As a federally chartered HBCU, Howard receives an annual appropriation to support University operations. Excluding Howard University Hospital (HUH), the University received a $217 million federal appropriation in fiscal year 2022. This funding source represents 37 percent of Howard University’s operating budget.

Philanthropic Gifts

In fiscal year 2022, Howard received the second-most philanthropic contributions in its history – $147 million – which accounted for the second-largest source of revenue for the University. Yet, as is typical with philanthropy, the majority of contributions (73 percent) are donor restricted for a specific use over time and/or purpose. For endowed gifts, the original investment is intended to exist in perpetuity. Therefore, spending on an endowed gift is limited to the earnings from those investments.

To ensure consistency in budgeting, universities use an annual spending rate to consistently allocate resources to the operating budget. At Howard University, the spending rate is 4 percent based on a three-year average value of each endowed gift. For example, a $1 million gift will provide $40,000 in annual operating budget support.

Grant Revenue

Another large funding source for Howard University is grant revenue. In fiscal year 2022, the University recognized $92 million in grant revenue. The University is also close to achieving its Howard Forward goal of $100 million of annual grant revenue and attaining the Carnegie designation of a Research 1 institution. Nonetheless, as with restricted gifts, grant revenue is restricted to cover expenses specific to the purpose of the grant.

Debt Financing

For capital expenses, a major source of funding is debt financing. Howard University issues bonds and utilizes the proceeds from those bonds for funding major capital projects (e.g., construction of the new steam plant). Using debt to finance capital projects allows the University to spread the impact on operating cashflows over the life of the bonds, typically 30 years. However, as with a home mortgage, the University pays annual interest and principal payments on those bonds using operating cashflows.

The University is limited in the amount of debt it can issue by financial covenants that are attached to each of the existing bond issues of the University. In addition to major capital projects funded by debt, the University funds smaller capital projects and maintenance expenses using operating cashflows.

As expenses increase at Howard, and as the University prepares for an historic real estate investment, tuition will remain an important funding component. But just as critically, the University is committed to keeping tuition low to ensure Howard remains an attainable higher education destination for all. The tuition increase this year reflects the University’s need to maintain financial sustainability in this environment of rising expenses and investments.

Howard University has a historic duty to provide opportunity to those who would not receive opportunity elsewhere. Even as we become one of the most selective institutions of higher education, we remain committed to also being one of the most affordable.

Stephen Graham is the chief financial officer of Howard University.