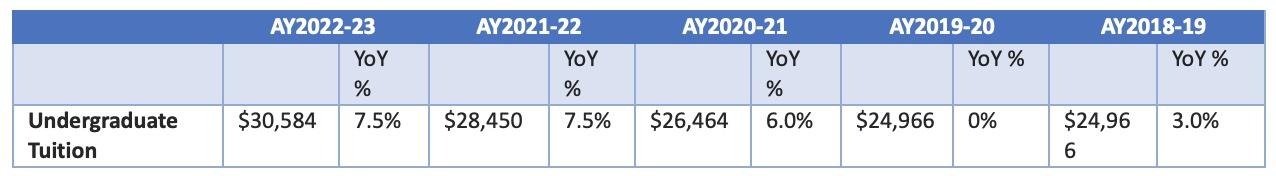

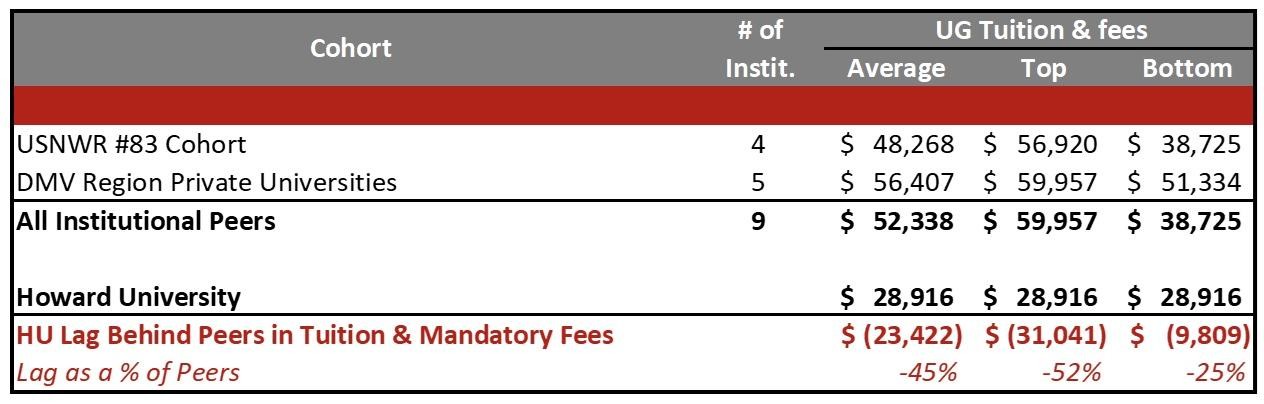

Howard’s undergraduate tuition and mandatory fees remains significantly lower than comparable institutions despite a 7.5 percent increase for the 2022-2023 academic year compared to the previous year, which will raise tuition to $30,584.

According to data from the 2020-2021 academic year, Howard’s tuition and fees were 50 percent lower than institutions with similar U.S. News & World Report rankings and 64 percent lower than private institutions in the Washington, D.C. area. Among the historically Black colleges and universities (HBCUs) with the five highest rankings, Howard’s undergraduate tuition and mandatory fees is only $583 higher than the average, and less than both Hampton University and Morehouse College, even though Howard is the only HBCU in the top 100 of national universities.

Net tuition and fees represent an important source of funding for Howard, especially as it is unrestricted and provides the University with the most flexibility in terms of pricing and use. In addition, Howard strives to return tuition and fee revenue in the form of scholarships to students. For fiscal year 2021, the University recognized $164 million of net tuition and fee revenue; gross tuition and fee revenue was $312 million and institutional aid was $148 million. Therefore, on average, for every dollar of tuition and fee revenue charged, 47 percent is provided back to students as a discount.

It is important to note that living expenses, such as housing and dining, are not included in the mandatory fees. Room and board and meal plans represent a separate cost that students incur. While we recognize that the tuition and mandatory fees do not encompass the full cost of attendance, this particular snapshot provides meaningful insight into the affordability of a Howard education.

The increase in operating expenses increase due to inflation, student services provided, regulatory requirements and strategic investments for future growth necessitated an increase in tuition rates in order to meet the University’s expenses. The tuition increase is being implemented at a time when the University, and the country as a whole, is facing pressure from levels of economic inflation not experienced in decades. In March 2022, the Consumer Price Index reported an 8 percent year-over-year inflation increase. As the cost of utilities, supplies, contract labor, travel and more continue to escalate, the University’s operating budget must increase proportionally. In addition, the current labor market for retaining and recruiting faculty and staff is extremely competitive. Therefore, wage inflation is also impacting the University’s operating budget. As the University continues to return campus life to pre-COVID-19 levels of services and experiences, the investments in student life activities will grow significantly next year as well.

Despite the difficult financial and economic environment, Howard strives to keep tuition and fee levels low by emphasizing other revenue sources.

Federal Appropriation

As a federally chartered HBCU, the University receives an annual appropriation to support the operations of the University. Excluding Howard University Hospital (HUH), the University received a $216 million federal appropriation in fiscal year 2021. This funding source represents 42 percent of the operating budget of Howard University.

Philanthropic Gifts

In fiscal year 2021, Howard received the most philanthropic contributions in its history – $177 million – which accounted for the second largest source of revenue for the University. However, as is typical with philanthropy, the majority of contributions received (64 percent) are donor restricted for a specific use over time and/or purpose. For endowed gifts, the original investment is intended to exist in perpetuity. Therefore, spending on an endowed gift is limited to the earnings from those investments. To ensure consistency in budgeting, Universities use an annual spending rate to consistently allocate resources to the operating budget. At Howard University, the spending rate is 4 percent based on a three-year average value of each endowed gift. For example, a $1 million gift would provide $40,000 in annual operating budget support.

Grant Revenue

Another large funding source for the University is grant revenue. In fiscal year 2021, the University recognized $86 million in grant revenue. The University is also close to achieving its Howard Forward goal of $100 million of annual grant revenue and achieving the Carnegie designation of a Research 1 institution. However, as with restricted gifts, grant revenue is restricted to cover expenses specific to the purpose of the grant.

Debt Financing

For capital expenses, a major source of funding is debt financing. The University issues bonds and utilizes the proceeds from those bonds for funding major capital projects (e.g. construction of the new steam plant). Using debt to finance capital projects allows the University to spread the impact on operating cashflows over the life of the bonds, typically 30 years. However, as with a home mortgage, the University pays annual interest and principal payments on those bonds using operating cashflows. The University is limited in the amount of debt it can issue by financial covenants that are attached to each of the existing bond issues of the University. In addition to major capital projects funded by debt, the University funds smaller capital projects and maintenance expenses using operating cashflows.

As expenses increase at Howard, and as the University prepares for a historic real estate investment, tuition will remain an important funding component. But just as critically, the University is committed to keeping tuition low to ensure that Howard remains an attainable higher education destination for all people. The tuition increase this year reflects the University’s need to maintain financial sustainability in this environment of rising expenses and investments. Howard has a historic duty to provide opportunity to those who would not receive opportunity anyplace else. Even as we become one of the most selective institutions of higher education, we remain committed to also being one of the most affordable.

Stephen Graham is the chief financial officer of Howard University.